Introduction:

The 10-year Treasury yield is a critical benchmark for measuring the health of the economy and influencing financial markets. It represents the interest rate at which the United States government borrows money by issuing 10-year Treasury notes. This article will delve into the significance of the 10-year Treasury yield, its impact on various sectors of the economy, and its implications for investors and policymakers.

Body:

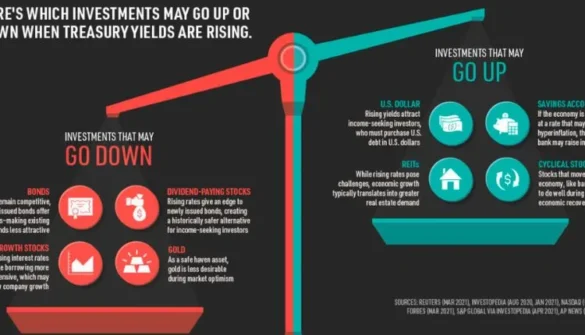

- Understanding the 10-Year Treasury Yield: The 10-year Treasury yield reflects investor sentiment regarding the future path of interest rates and inflation. It serves as a reference point for determining borrowing costs across the economy, including mortgages, corporate loans, and consumer credit. When the yield rises, it indicates a perception of higher inflation or stronger economic growth, while a declining yield suggests the opposite.

- Impact on Financial Markets: a. Bonds: The 10-year Treasury yield heavily influences bond prices. As yields rise, existing bond prices fall, making new bonds with higher yields more attractive. Conversely, when yields decline, bond prices tend to rise, leading to lower yields on newly issued bonds. b. Stocks: The relationship between the 10-year Treasury yield and stock prices is complex. While higher yields can attract investors away from equities, indicating increased competition for capital, they can also signal a robust economy, which can be positive for corporate profits and stock market performance. c. Foreign Exchange: Changes in the 10-year Treasury yield can impact currency exchange rates. Higher yields tend to strengthen the U.S. dollar, as they attract foreign investors seeking higher returns on their investments. d. Commodities: The 10-year Treasury yield indirectly affects commodity prices. When yields rise, the opportunity cost of holding non-yielding assets like commodities increases, leading to potential price declines. Conversely, falling yields can boost commodity prices.

- Impact on Borrowing Costs: The 10-year Treasury yield serves as a benchmark for determining borrowing costs in various sectors. a. Mortgages: Mortgage rates often closely follow the 10-year Treasury yield. As the yield rises, mortgage rates tend to increase, making homeownership more expensive. Conversely, declining yields can lower mortgage rates, stimulating demand for housing. b. Corporate Loans: Companies with higher credit ratings often tie their borrowing costs to the 10-year Treasury yield. When the yield rises, borrowing costs increase, potentially impacting corporate investment and expansion plans. c. Consumer Credit: Changes in the 10-year Treasury yield can influence interest rates on consumer loans, such as auto loans and credit cards. Higher yields may lead to higher borrowing costs for consumers, reducing their purchasing power.

Conclusion:

The 10-year Treasury yield is a crucial indicator of market sentiment, impacting a wide range of financial instruments and sectors. Investors, policymakers, and individuals should closely monitor the yield’s movements as it provides valuable insights into inflation expectations, economic growth prospects, and borrowing costs. Understanding the interplay between the 10-year Treasury yield and various financial markets is essential for making informed investment decisions and formulating effective monetary policies.

FAQs:

- How does the 10-year Treasury yield affect mortgage rates? The 10-year Treasury yield serves as a reference point for mortgage rates. When the yield rises, mortgage rates tend to increase, making borrowing for homeownership more expensive. Conversely, when yields decline, mortgage rates often follow suit, providing potential savings for homebuyers.

How does the 10-year Treasury yield impact stock market performance? The relationship between the 10-year Treasury yield and stock market performance is complex. Higher yields can attract investors away from equities, as they offer higher returns without the inherent risk associated with stocks. However, rising yields can also signal a strong economy, leading to increased