Shopify is a leading e-commerce platform that enables businesses to sell their products and services online. The company has witnessed phenomenal growth in recent years, and its stock has been a favorite among investors. In this article, we will take a closer look at Shopify’s growth prospects, financial performance, and potential risks.

Shopify’s Growth Prospects:

Shopify’s growth prospects are bright due to several factors. First and foremost, the global e-commerce market is expanding rapidly, and Shopify is well-positioned to benefit from this trend. The company’s revenue has been growing consistently over the past few years, and its revenue growth rate has accelerated during the pandemic.

Secondly, Shopify’s platform is highly scalable and versatile, making it attractive to businesses of all sizes. The company has over 1.7 million merchants using its platform, and it is continuously adding new features to enhance the user experience. Furthermore, Shopify’s app store offers a wide range of tools and integrations that can help businesses optimize their online sales.

Finally, Shopify has been expanding its services beyond e-commerce. For example, the company has launched a buy-now-pay-later service called Shop Pay Installments, which can help businesses boost their sales by making it easier for customers to purchase products.

Financial Performance:

Shopify’s financial performance has been impressive, and the company’s revenue growth rate has been consistently high. In 2020, the company’s revenue grew by 86% compared to the previous year, reaching $2.93 billion. The company’s gross merchandise volume (GMV) also increased by 96% year-over-year, indicating strong demand for its platform.

Furthermore, Shopify’s net income has been positive since 2016, and the company has consistently generated positive cash flows from operations. However, it is worth noting that Shopify’s net income margin is relatively low compared to other tech companies. In 2020, the company’s net income margin was 4.6%, which is lower than the industry average.

Potential Risks:

Despite Shopify’s strong growth prospects and financial performance, there are several potential risks that investors should consider. One major risk is competition. Shopify faces intense competition from other e-commerce platforms such as Amazon, eBay, and Walmart. These companies have significant resources and are constantly improving their platforms to attract more merchants.

Another risk is the dependence on third-party apps and integrations. Shopify’s app store is a vital part of its ecosystem, but the company relies on third-party developers to create and maintain these apps. If these developers stop supporting Shopify or if there are security or quality issues with the apps, it could negatively impact the user experience and hurt Shopify’s reputation.

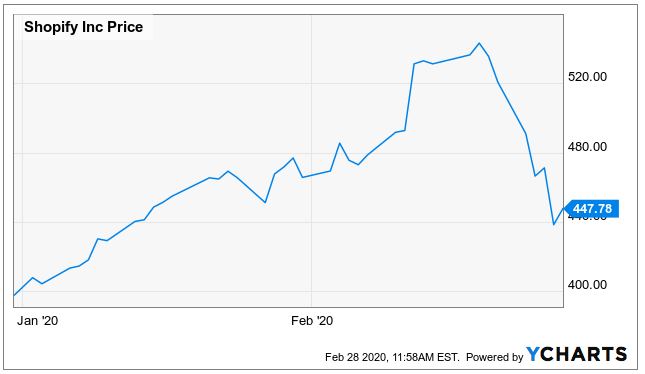

Finally, Shopify’s stock valuation is relatively high compared to its peers. The company’s price-to-sales ratio is over 50, which is significantly higher than the industry average. This high valuation makes the stock more vulnerable to market fluctuations and increases the risk of a potential downturn.

Conclusion:

Shopify is a high-growth company with strong fundamentals and a versatile platform that can benefit businesses of all sizes. The company’s financial performance has been impressive, and its growth prospects are bright. However, investors should be aware of the potential risks, including intense competition, dependence on third-party apps, and a high valuation. Overall, Shopify’s stock can be a valuable addition to a well-diversified portfolio, but investors should conduct thorough research and analysis before making any investment decisions.